How SmartSaver works in the background

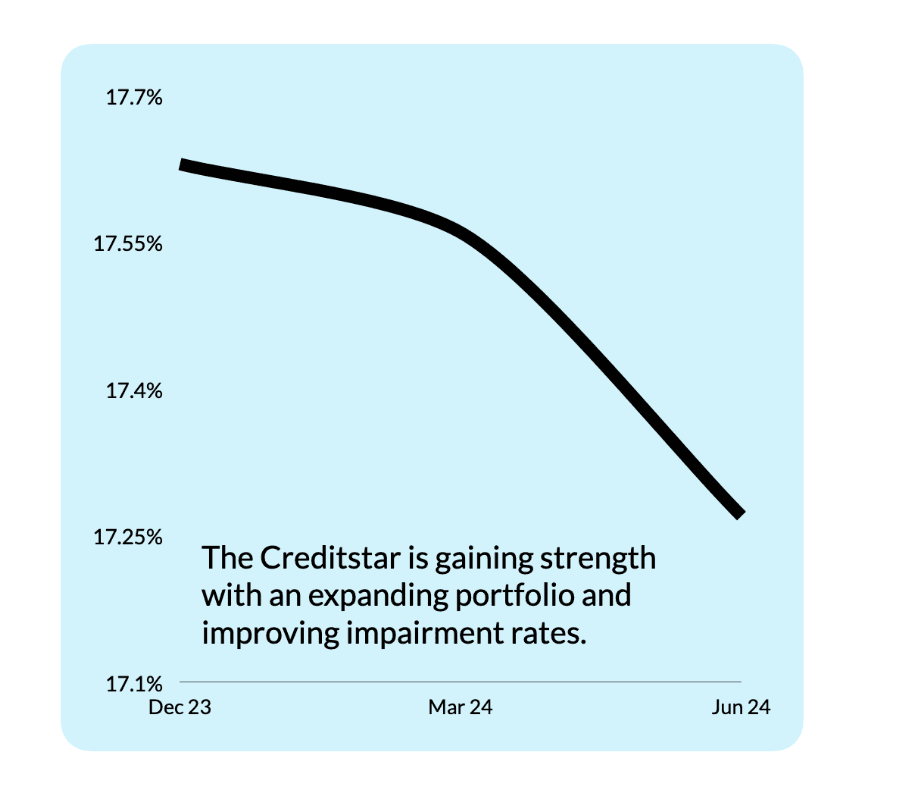

When you invest with Monefit SmartSaver, your funds are strategically allocated to support consumer loans issued by the Creditstar Group. Essentially, your investment backs these loans, which are carefully managed with transparent records tracking exactly where your money goes.

Monefit, part of the Creditstar Group, provides loans across eight countries. The interest generated from these loans allows SmartSaver to offer attractive returns to help our investors grow their wealth effortlessly. Here’s a quick snapshot of the loan side of things:

- The average loan amount is €1,668

- Most borrowers are aged between 18 and 45

- The average interest rate on loans is 32%

- A typical loan has a 12-month term

Please have a look at one of our previous blogs, Uncover the Monefit SmartSaver Secret: Measured Investment Safety with High Returns, where we talk about this structure in a little more detail.

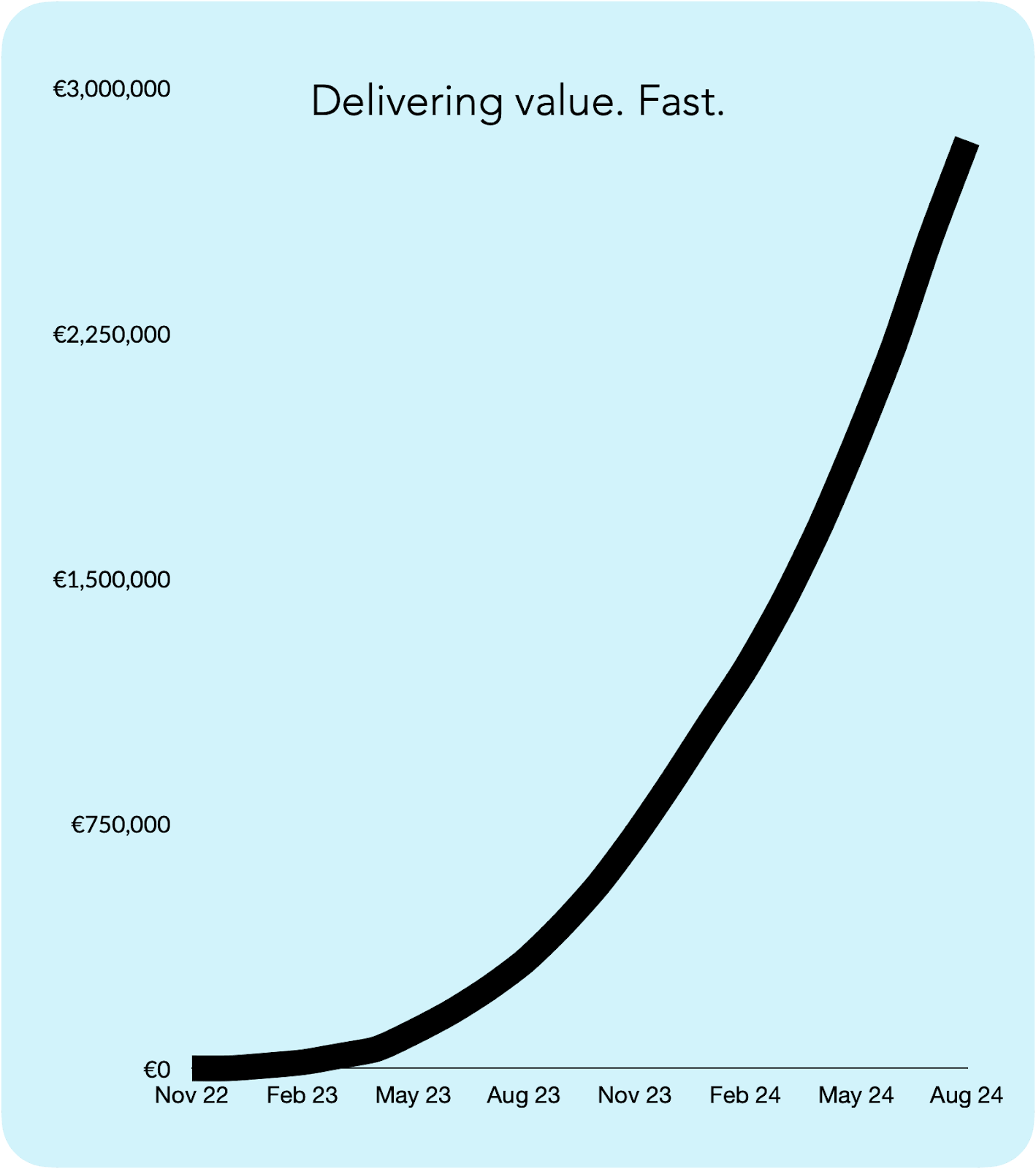

What SmartSaver investors have earned so far

One of the most attractive features of SmartSaver is the daily returns it provides to investors. As your balance grows, so do your returns.

Here are some impressive stats from SmartSaver:

- Total wealth created: €2.8 million and counting

- Highest APY earned: 9.96%

- Largest return by an individual: over €20,000

These are the actual returns our investors are achieving with SmartSaver! Whether you’re saving for a dream vacation or planning for retirement, our community is smashing their financial goals faster than expected.

- Investor 1. €20,021

- Investor 2. €19,469

- Investor 3. €18,592

- Investor 4. €18,148

- Investor 5. €17,587

And if you have a long-term financial goal – maybe a new home, a dream vacation, or sending your kid to university – you can achieve even higher returns with a SmartSaver Vault.

You can open 6- or 12-month Vaults with APYs of 8.87% and 9.96%, respectively. Vaults allow you to save for a set period and know exactly what you’ll earn.

- More than 37% of investors use Vault.

- More than 62% of Vaults are held for the full 12 months.

- Investors are opening a new Vault every 30 minutes.

- The largest Vault account of €209,000 is earning €21k per year!

💡If you set up a new Vault each month, you’ll have money maturing and paying out monthly in the following year. It’s a simple way to create a steady stream of income.

Ready to start growing your wealth?

So, those are the numbers. Nice and bold.

SmartSaver is already helping more than 14,000 investors grow their wealth every day. If you haven’t joined yet, what’s holding you back?

You can start saving from just €10, and you’ll get a €5 bonus just for starting your account. It’s never been easier to start building your wealth!

*The information presented in this blog post is valid as of the time it is published. The content is intended to provide information only and is not meant and should not be considered as financial or investment advice of any kind.