In today’s fast-paced financial landscape, traditional banking options often fall short of meeting the diverse needs of investors, especially when the investor is looking for fixed-income returns on their investment and wants to diversify their portfolio.

Recognising this gap, we introduced the Monefit SmartSaver, which not only offers attractive returns on investments but is also designed with safety at its core. In this article, we’ll take a closer look at how Monefit SmartSaver works and the structure, operation, and layers of safety we’ve integrated.

How Monefit SmartSaver Uses Investor Money

When you choose to invest with Monefit SmartSaver, your funds are intelligently allocated into existing or new consumer loans issued by the Creditstar Group. In essence, your money backs these consumer loans, which are managed meticulously with detailed records tracking where your investments are directed.

Creditstar Group, with its technological edge, utilises advanced algorithms, automation, and data analysis to make credit products accessible to customers across multiple countries, including Estonia, Finland, Poland, Spain, Sweden, Denmark, the Czech Republic, and the United Kingdom. Your investment contributes to the growth of these consumer loans.

Not a Bank, But a Financial Technology Company

It’s essential to note that neither Monefit nor Creditstar operate as banks. Consequently, the money you invest with them is not government-insured or guaranteed. Instead, both companies are financial technology innovators, distinct from traditional banks. Therefore, our services are not subject to any Financial Services Compensation Schemes.

The Financial Strength of Creditstar Group, its Resilient Capital Structure, and Effective Regulatory Compliance

As an investor considering Monefit SmartSaver, understanding Creditstar Group’s financial strength and capital structure is essential. Creditstar Group is a profitable international financial business operating since 2006. Let’s dive into the details:

Strong Financial Standing:

- Net Loan Portfolio: €235 million

- Average return from Loans: 28%

- Annual Percentage Yield (APY) for Monefit SmartSaver Investors: Between 7.25% – 8.33%

Creditstar Group consistently generates earnings that exceed what it pays to investors. The surplus funds are allocated strategically, with a focus on three key areas: building loan loss reserves, covering operating costs, and driving the bottom line profits.

Creditstar Group consistently generates earnings that exceed what it pays to investors. The surplus funds are allocated strategically, with a focus on three key areas: building loan loss reserves, covering operating costs, and driving the bottom line profits.

Robust Capital Structure:

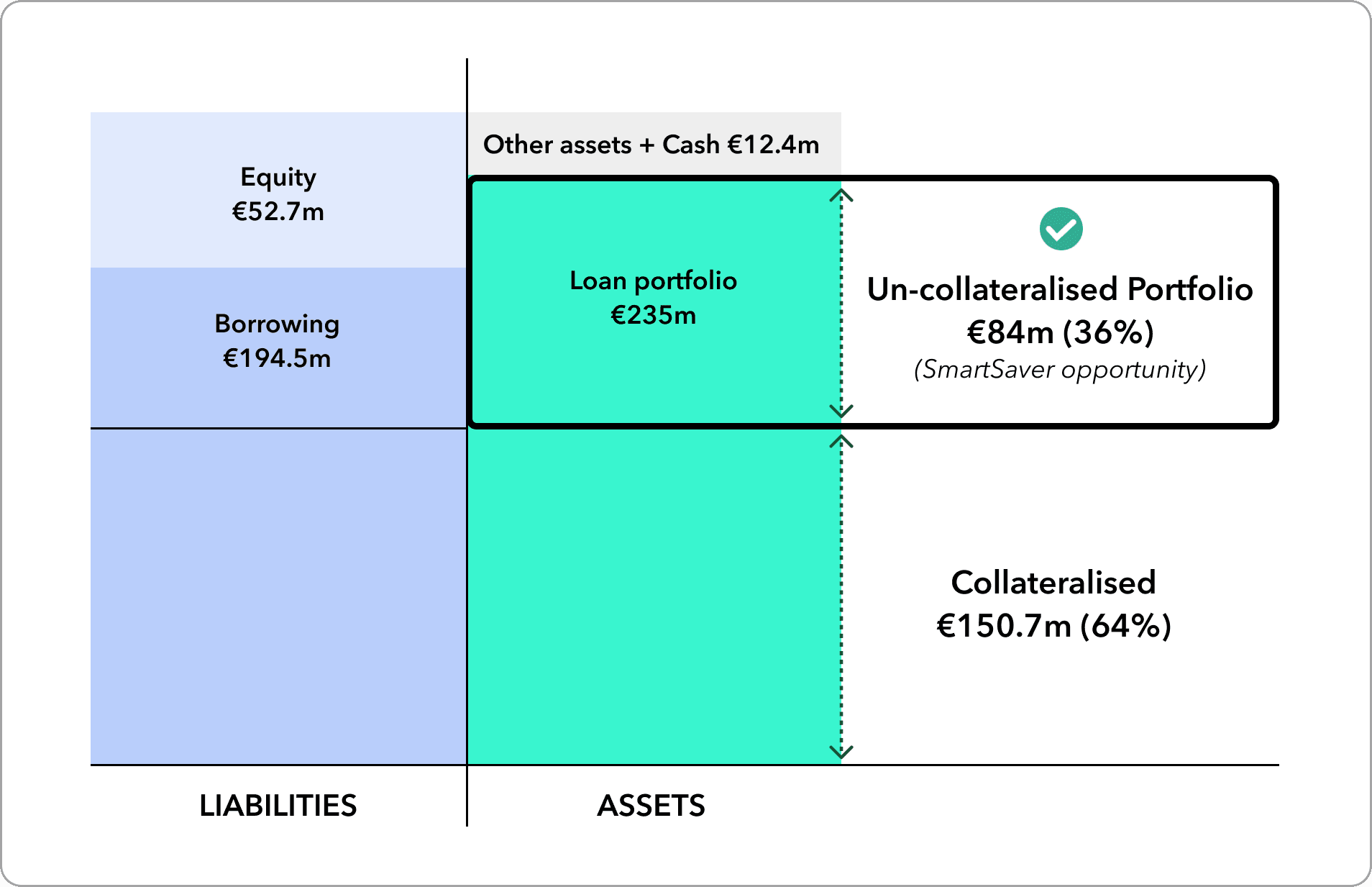

Creditstar Group’s capital structure reflects its stability and strategic approach to financial management. Here’s the breakdown:

- Equity: €52.7 million

- Un-collateralised Corporate Loans: €39.2 million

- Collateralised Borrowings: €75.2 million in bonds, €70.8 million in P2P (including SmartSaver investments) financing, and €4.7 million in line of credit.

Of Creditstar’s €235 million loan portfolio, approximately €150.7 million (64%) is collateralised, ensuring added security for existing investors. The remaining un-collateralised segment stands at €84 million (36%). This un-collateralised portion mostly presents potential growth for Monefit SmartSaver. This segment continues to expand as Creditstar rapidly extends its lending operations across all markets. So the current opportunity is not closed-ended.

Regulations and Audit:

Operating in multiple countries, Creditstar adheres to local lending regulations and responsible lending principles. To enhance transparency, our annual financial statements undergo an external review by KPMG, a prominent member of the Big Four audit companies.

Defying Risk Like Never Before

Creditstar spreads its credits across eight countries and diversifies across various sectors, reducing overall risk. Moreover, the maximum loan size is capped at €10,000, minimising concentration risk.

For a detailed overview of Creditstar’s loan portfolio split and specifics, you can refer to pages 36 and 37 in Note 4 of Creditstar’s KPMG audited 2022 Annual Report.

Handling Simultaneous Withdrawals With Confidence

Investors often wonder what would happen if a significant number of individuals decided to withdraw their funds at the same time from Monefit SmartSaver. It’s a legitimate concern, and we want to put your mind at ease.

Monefit SmartSaver primarily invests in consumer loans. We understand that the investment landscape calls for adaptability and flexibility. So, rest assured that even though certain consumer loans might have longer terms, such as instalment loans or extended maturity credit lines that span up to three years or more, we are well-prepared to meet your withdrawal needs.

We maintain liquidity reserves to meet our payment obligations to investors if simultaneous withdrawals ever occur. As Monefit SmartSaver continues to grow, we continually monitor and adjust our liquidity system to ensure its efficiency.

In the rare event that a substantial number of our investors request withdrawals simultaneously, we have a plan in place. Withdrawals may be processed gradually over time, ensuring fairness for all investors. Please know that our top priority is to maintain your satisfaction and trust, even in the most exceptional circumstances.

Since the launch of Monefit SmartSaver, we’ve successfully processed over 2500 withdrawals within our promised Service Level Agreement (SLA) of 10 business days. At the Creditstar Group level, thousands of our investors have earned over €100 million in return. Our commitment is to ensure our investors receive their payouts promptly when they need them most. We’re continuously innovating to shorten the payout window, making your experience even smoother.

We’ve also made significant investments in our customer service to provide you with quick and helpful answers to any questions you may have regarding your withdrawals. We take pride in delivering a top-tier customer experience and setting industry benchmarks, as reflected in our Excellent Trustpilot rating.

SmartSaver: The Next Evolution of Modern Investment

In an era where traditional banking often underwhelms, we proudly present Monefit SmartSaver. This investment tool not only offers investors up to 8.33% APY – a superior return in its product category – but also champions transparency, with no hidden fees and the flexibility to access funds as needed. But remember, every financial superhero has its limits. Understand the risks, seek expert advice, and know that while returns are promising, capital protection isn’t guaranteed. But our promise is unwavering—we’re here to work towards safeguarding your financial future and helping you live your best financial life.

Best Regards,

Christian Isaksen

VP of Operations

*The information presented in this blog post is valid as of the time it is published. The content is intended to provide information only and is not meant and should not be considered as financial or investment advice of any kind.