Creditline whenever you need it

- Borrow up to €10K

- Annual interest rate from 4.49%

- 30 days interest free

- Payment holiday

- Quick decision and payout

- Affordable and flexible monthly payments

Get the credit you deserve

A flexible line of credit with no hidden fees and fair repayment terms.

Money when you need it

Available in:

- Estonia

- Spain

- Finland

- Sweden

- Czech Republic

Coming soon:

- Poland

- Denmark

Quick & easy

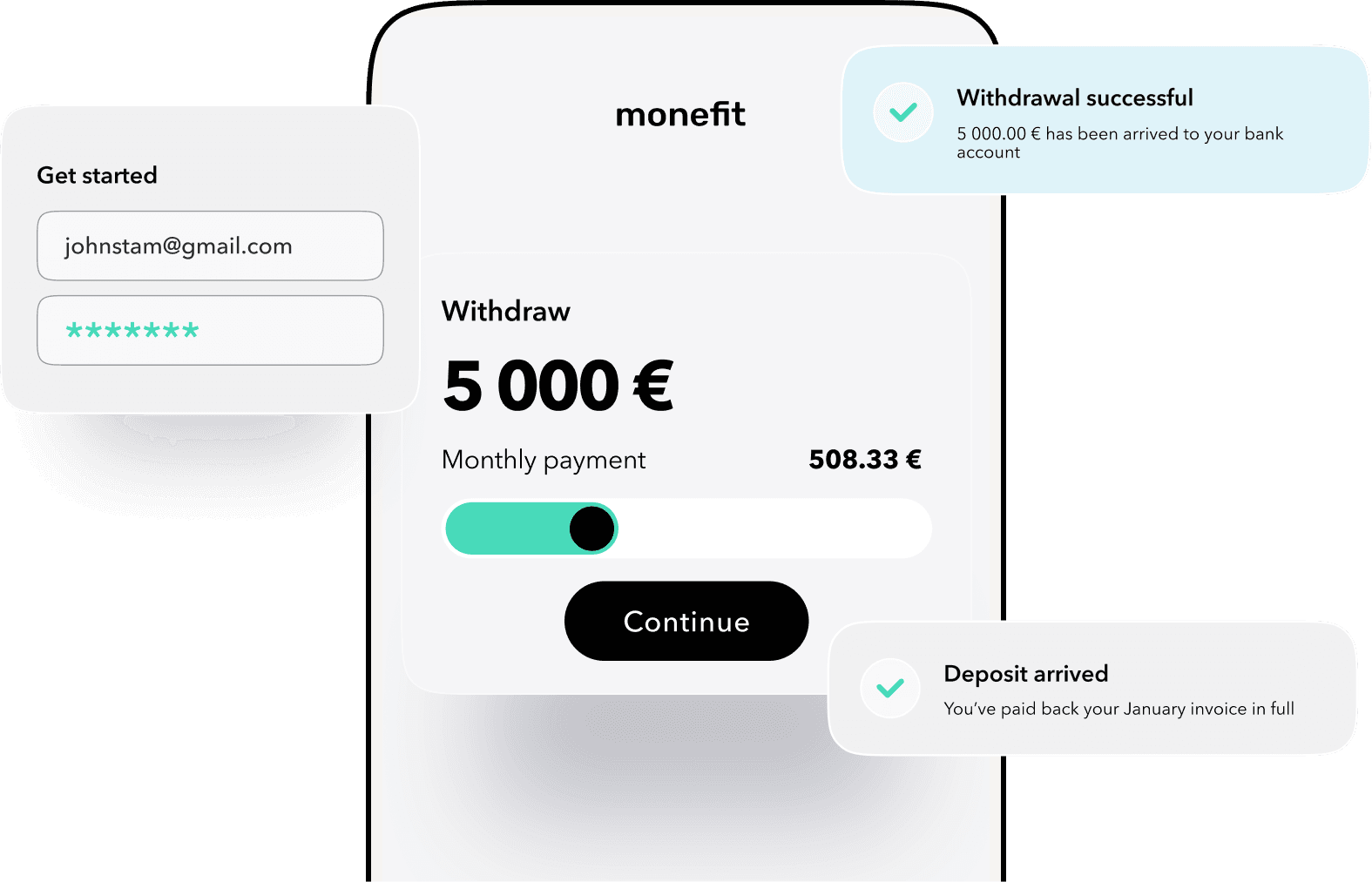

Get an instant decision, and then draw down the money you need, when you need it.

Affordable & flexible

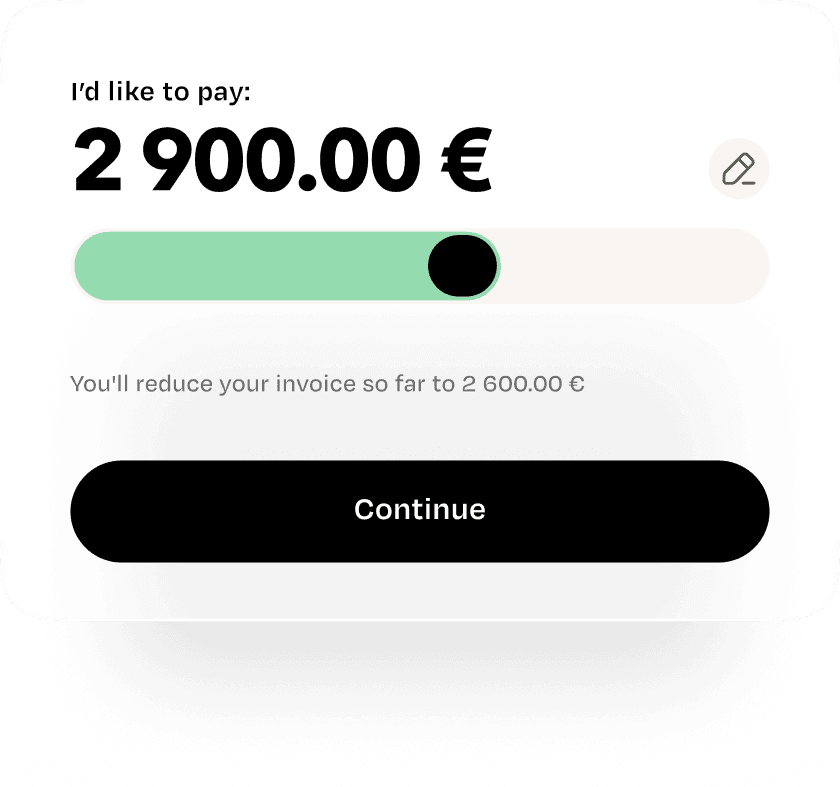

Repay based on what you’ve borrowed, make minimum monthly payments, or repay the full amount with no extra charge. Whatever works for you.

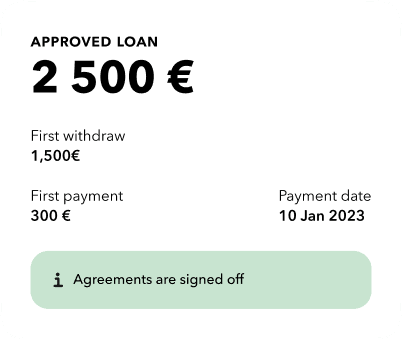

Apply, Drawdown, Use, Repay

With a quick application process, and an instant decision, you’ll get fast access to your line of credit, to use as you need. Manage everything in your dashboard, and never miss a repayment.

Don’t miss a repayment with notifications

We’re always ready to help - chat to us, or email

Manage your money in your Monefit dashboard

Putting dreams within reach

Money to make sure the big moments in your life can happen now, without the wait.

Boring But Important

Every loan is a financial obligation. Before signing the contract, familiarize yourself with the terms of the service and consult with an expert.

We're regulated

Monefit operates in full compliance with financial regulations in all markets where we offer lending services.

We lend responsibly

Your investment is diversified into consumer credit agreements carefully vetted by Creditstar Group.

Representative example

A credit line of €1,000, total amount paid by the consumer and the amount of repayments €1,216.58, fixed interest rate of 37.85% per annum and APR of 45.89% per annum. The credit cost rate has been calculated on the assumption that the credit line will be used in full and will be repaid in 12 equal repayments at equal intervals from the month after the credit line was put into use.