We’re always on the lookout for ways to make saving not just easier but also more rewarding for you. We believe in keeping things straightforward and efficient. This past year, we’ve had some great chats with many of our users. We wanted to know what gets our users excited about our SmartSaver and how they’re using it to support their dreams.

We’ve discovered some pretty cool stuff from these conversations. First off, everyone loves seeing their investment grow effortlessly (who wouldn’t, right?). Plus, we found out that people from over 40 countries are using SmartSaver to save for what truly matters to them. Whether it’s buying that dream house, jetting off on the vacation of a lifetime, getting behind the wheel of a new car, celebrating love with a big wedding, or investing in their children’s future, the dreams are as big as they are varied. And you know what? Helping you achieve these dreams is what excites us the most.

So, here’s the big news: we’ve made some awesome strides in making those dreams come a bit closer to reality. We’re introducing something we call the Vault. Think of it not as your ordinary bank locker but as a magic chest that not only safeguards your treasures but also multiplies them. The Vault is all about helping you reach your life’s milestones quicker.

So, here’s the big news: we’ve made some awesome strides in making those dreams come a bit closer to reality. We’re introducing something we call the Vault. Think of it not as your ordinary bank locker but as a magic chest that not only safeguards your treasures but also multiplies them. The Vault is all about helping you reach your life’s milestones quicker.

How does the Vault boost your wealth?

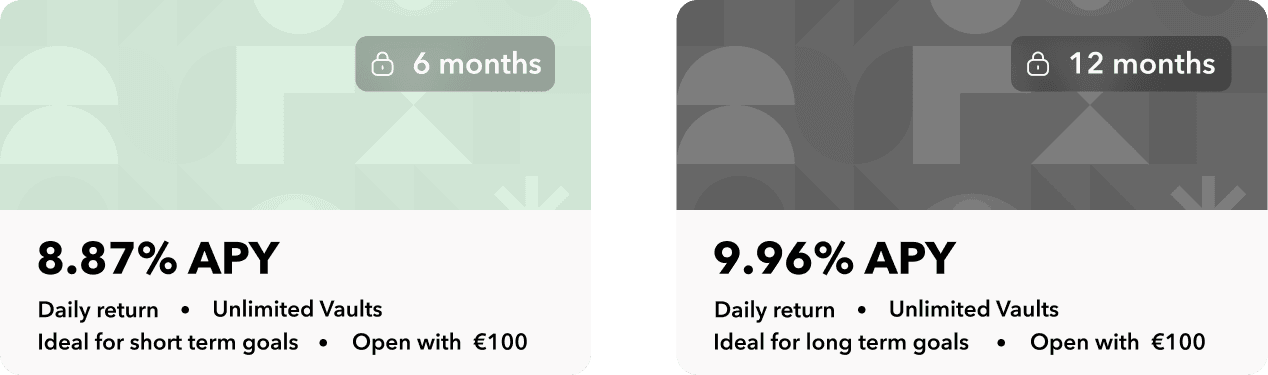

The concept is simple: park your money in a Vault for either 6 month or 12 month, and in return, enjoy higher returns. The returns in the Vault compounds daily, just like in your main SmartSaver account, but at a better rate.

Imagine naming your Vault with something fun like “Dream Bike Fund” or “Hawaii Trip” or “Holiday home in Spain”. It turns your Monefit SmartSaver into an exciting journey towards something you really want, instead of just stashing cash away. Every investment you make feels like a step closer to your dream.

Getting started is easy

With SmartSaver, you have exclusive access to our Vault. Just like everything else with SmartSaver, we’ve made using Vault super simple. Here’s how it works:

- Create your Vault: Name it after your goal or something fun; it’s your choice.

- Choose your term: Opt for a 6-month or 12-month period.

- **Transfer funds: **Start with as little as €100 and top up anytime during the first 10 days with a minimum of €10.

- Track Your Growth: Watch your investment grow with both current and projected earnings clearly visible in your Vault.

- You can create as many Vaults as you like.

Remember, your Vault is for the long haul; withdrawals are paused until the term ends, ensuring your savings work as hard as you do. When the term is up, your Vault balance will automatically move back to your main account. Read the terms and conditions for more information.

Maximise your return with Monefit

Keep some funds in your main account; which has easy access to withdrawals (10 business days) and allocate the rest to your Vault, choosing longer terms for higher returns. With a generous limit of €500,000 for SmartSaver accounts, you have plenty of room to grow your wealth.

Set up your Vault, transfer your funds, and then sit back and enjoy watching your savings expand every day.

*The information presented in this blog post is valid as of the time it is published. The content is intended to provide information only and is not meant and should not be considered as financial or investment advice of any kind.